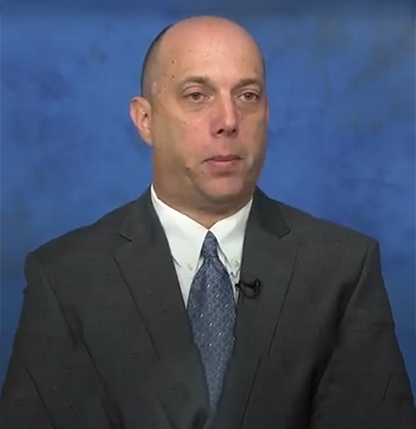

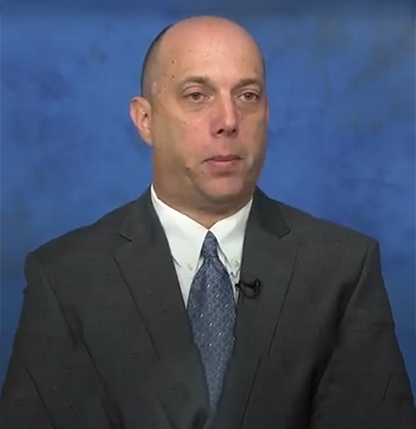

My goal is to help clients find creative solutions to complex problems so they can move forward from a very difficult time to a brighter more secure future.

Helping clients make a fresh start. Alan R. Crane is a Partner in the firm who represents clients facing one of the most difficult legal challenges: bankruptcy. Alan’s knowledge of complex laws and his creative problem-solving capabilities help individuals and businesses make a fresh start and gain a clearer picture of their futures.

Extensive experience in all facets of bankruptcy. As a seasoned bankruptcy attorney, Alan represents debtors and creditors, individuals and businesses alike. In assisting debtors that need to file bankruptcy, Alan explores the available options and guides individuals and businesses through the process that is in their best interests. When representing creditors or defendants in a bankruptcy proceeding, Alan seeks to protect their rights and assets.

Solutions tailored to each client. From experience Alan knows that all bankruptcies are not the same and clients are looking for individualized guidance. Alan takes time to listen, understand, and advise clients on utilizing the law to their advantage in each case. Going through bankruptcy is difficult for businesses and individuals alike as they look for answers. Alan’s counsel takes the weight of uncertainty off their shoulders, enabling them to preserve assets, shed debt, and see a way forward.

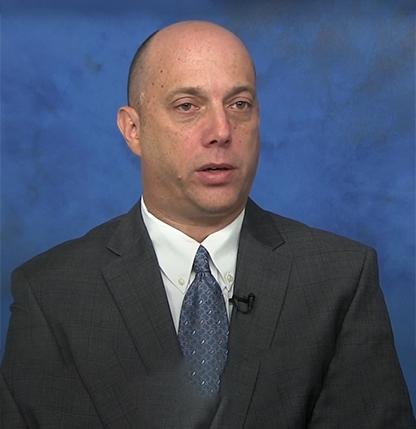

In addition, he had $785,000 in unsecured debt. He was able to discharge all of his debts without paying anything to the bankruptcy estate.

and was behind on the mortgage payments on his principle residence. Loan modification allowed him to save his principle residence and reduce his interest rates. He was able to maintain the payments on his non-dischargeable student loans and pay other general unsecured creditors $1200 while saving all of his assets, including his professional practice.

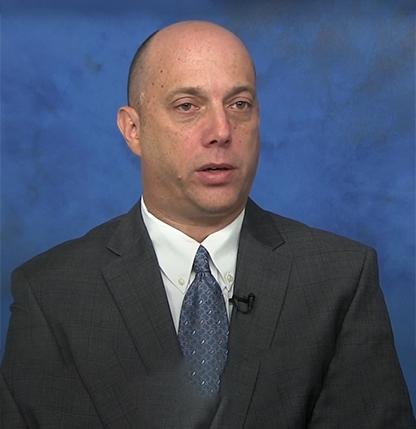

The financial advisor committed suicide after the Ponzi scheme collapsed and was exposed. A negotiated settlement with the financial advisor’s estate recovered the Client's life savings and her children’s college funds.

In addition, he had $785,000 in unsecured debt. He was able to discharge all of his debts without paying anything to the bankruptcy estate.

A negotiated settlement with the storage facilities and the pharmaceutical companies prevented the loss of their records, which would have cost millions of dollars and delayed bringing drugs to market.

"*" indicates required fields